EYE is a tool for simulating wholesale energy markets. You can use it to explore the business case of assets acting on the wholesale energy market, to investigate (future) market dynamics on eg the wholesale hydrogen market, and to explore the impact of contracts (like contracts for differences) on both individual assets and the market as a whole.

EYE uses ESDL as its main input, and comes with an ESDL-based Dutch energy system scenario containing current and planned energy assets in the Netherlands. User can also configure their own scenarios using ESDL. In addition, EYE uses ESDL as the base for its internal data model: any asset you configure in ESDL is represented the same internally.

EYE is frequently used to: – Explore the business case of assets acting on the wholesale energy market – Explore the impact of bidding strategies and contracts – Analyze the impact on the energy system as a whole: eg use of renewable energy, impact on other assets

How does EYE work?

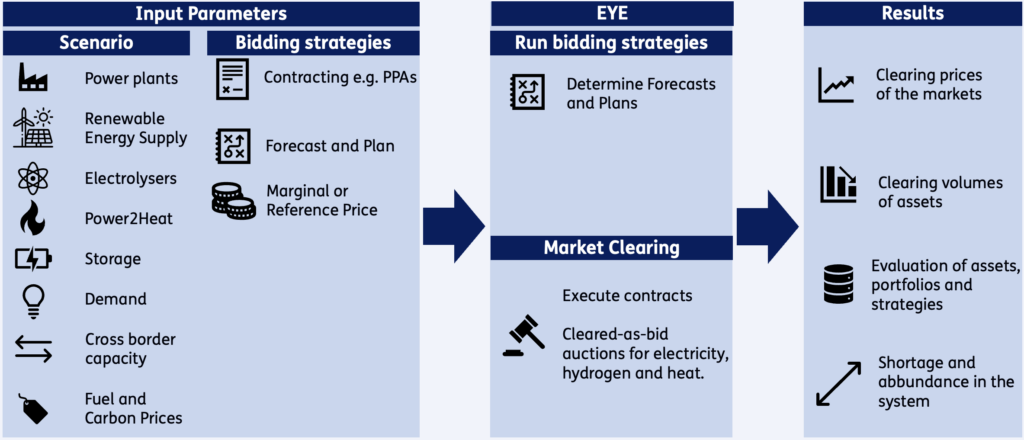

When simulating a scenario, EYE queries each asset for its bids on each of the relevant energy markets. These markets are then cleared, and assets are notified of the market results. This cycle then repeats for each hour in the simulation. EYE then stores all market and asset data in a database: clearing prices, asset dispatch, emissions, and more. Dashboards are provided for easy access to the data. EYE usually takes about 2 minutes to complete a simulation, allowing for quick iteration.

An important variable in the simulations is the bidding strategies: how do assets determine what to bid on the energy markets? EYE comes with a set of default bidding strategies that assume marginal cost pricing. This means that renewables usually bid at €0/MWh, and power plants bid depending on the configured prices for gas and biomass. These default strategies work well as a baseline for the simulation, and produce sensible results.

If the user wants to simulate different strategies, they can configure custom bidding strategies that EYE will use for specific assets. This way, users can use EYE to model all kinds of Power Purchase Agreements (PPAs), constraints on production (such as grid constraints), and other considerations that impact the bids an asset submits. This is in contrast to dispatch optimization models, which usually optimize the market as a whole. By allowing users to configure 'non-optimal' but more realistic strategies, many EYE makes it possible to investigate many more aspects of energy trading (such as PPAs and various other contracts).

Want to know more?

If you're interested in learning more about EYE, please contact us Aliene van der Veen, Western Coenraads and Pieter Verstraten.